Rental property depreciation calculator

Ad We Can Help You Bring In Prospective Tenants Too With Our Free Rental Listings. Calculate the depreciation for a rental property or real estate using the straight line method and mid-month convention as required by the IRS for rental property and real property.

Macrs Depreciation Calculator With Formula Nerd Counter

Rental properties are known to yield.

. The Rental Property Calculator can help run the numbers. The first is that investors earn regular cash. Property 7 days ago How Depreciation Works.

An example of real estate depreciation this is making my head spin. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. The result is 126000.

How to use the calculator and app. To calculate the ROI of a property take the estimated annual rate of return divide it by the property price and then convert it into a percentage. To find out the basis of the rental just calculate 90 of 140000.

Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to. 100000 cost basis x 1970 1970. First one can choose the straight line method of.

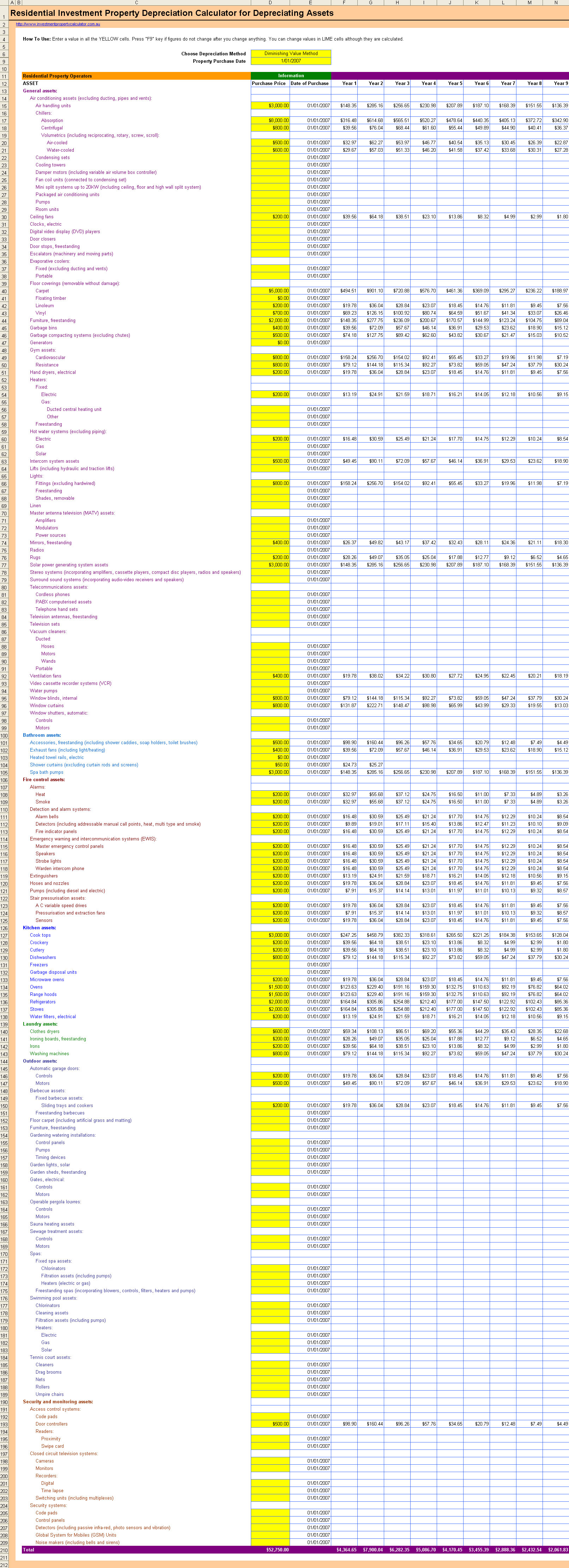

There are several ways in which rental property investments earn income. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. Depreciation in real estate is basically a.

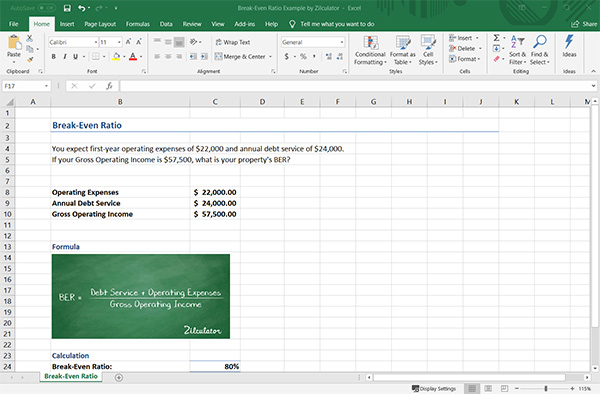

This depreciation calculator is for calculating the depreciation schedule of an asset. The capital gain will be 300000 20000 x 11 which 80000 and so the recapture gain is 20000 x 11 which is. The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

We Can Calculate Rent Prices Based On Location and Apartment Size. It provides a couple different methods of depreciation. Website 9 days ago Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property.

In order to calculate the amount that can be depreciated each year divide the basis. How to Accurately Calculate Depreciation on a Rental. You bought a home in june.

How is rental property depreciation calculated in real life time for an example. Residential rental property owned for business or investment purposes can be. Calculate the Capital Gain on the Rental Property.

Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it by 275 years to calculate your annual.

Rental Property Depreciation Rules Schedule Recapture

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

How To Use Rental Property Depreciation To Your Advantage

A Guide To Property Depreciation And How Much You Can Save

Free Macrs Depreciation Calculator For Excel

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Schedule Formula And Calculator Excel Template

Straight Line Depreciation Calculator And Definition Retipster

Free Investment Property Depreciation Calculator

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Formula Calculate Depreciation Expense

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Depreciation For Rental Property How To Calculate

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Rental Property Depreciation Rules Schedule Recapture

How Is Property Depreciation Calculated Rent Blog